Last week, I wrote about how to best monetize with an Open Core model. In a nutshell, you contribute developer/practitioner capabilities to open source while keeping executive capabilities proprietary (tentatively you also keep manager capabilities proprietary, although there are pros and cons[1]). The underlying assumption of that blog post was that Open Core is the better model for monetizing an open source project as a commercial vendor. I didn’t provide a lot of reasoning for that and wanted to follow-up to share my thinking. Before we do so, let’s look at the alternative. There is really only one - providing a Stable Release.

Red Hat is often mentioned as the “original” open source vendor. For good reasons. RHT went public in 1999 and grew to a $3.7B annualized revenue run rate before getting acquired by IBM for $34B. In purely financial terms, it’s still the most successful open source vendor ever. Nobody comes even close. Out of all the public companies, MongoDB leads the pack with a market cap of $14.6B; Elastic comes in second at $9.5B. Both are younger companies and still growing incredibly well. But they will need many more years to get close to Red Hat’s revenue pre-acquisition (MongoDB’s annualized revenue rate is $521M, Elastic’s is $494M).

| Company | Valuation | Annualized Revenue Run Rate |

|---|---|---|

| Red Hat | $35.0B (acquired) | $3,736M |

| MongoDB | $14.6B | $521M |

| Elastic | $9.5B | $494M |

| Mulesoft | $6.5B (acquired) | $310M |

| Databricks | $6.2B | - |

| Hashicorp | $5.1B | - |

| Confluent | $4.5B | - |

| Cloudera | $4.1B | $842M |

| Automattic | $3.0B | - |

Some of the most successful open source vendors in the world.

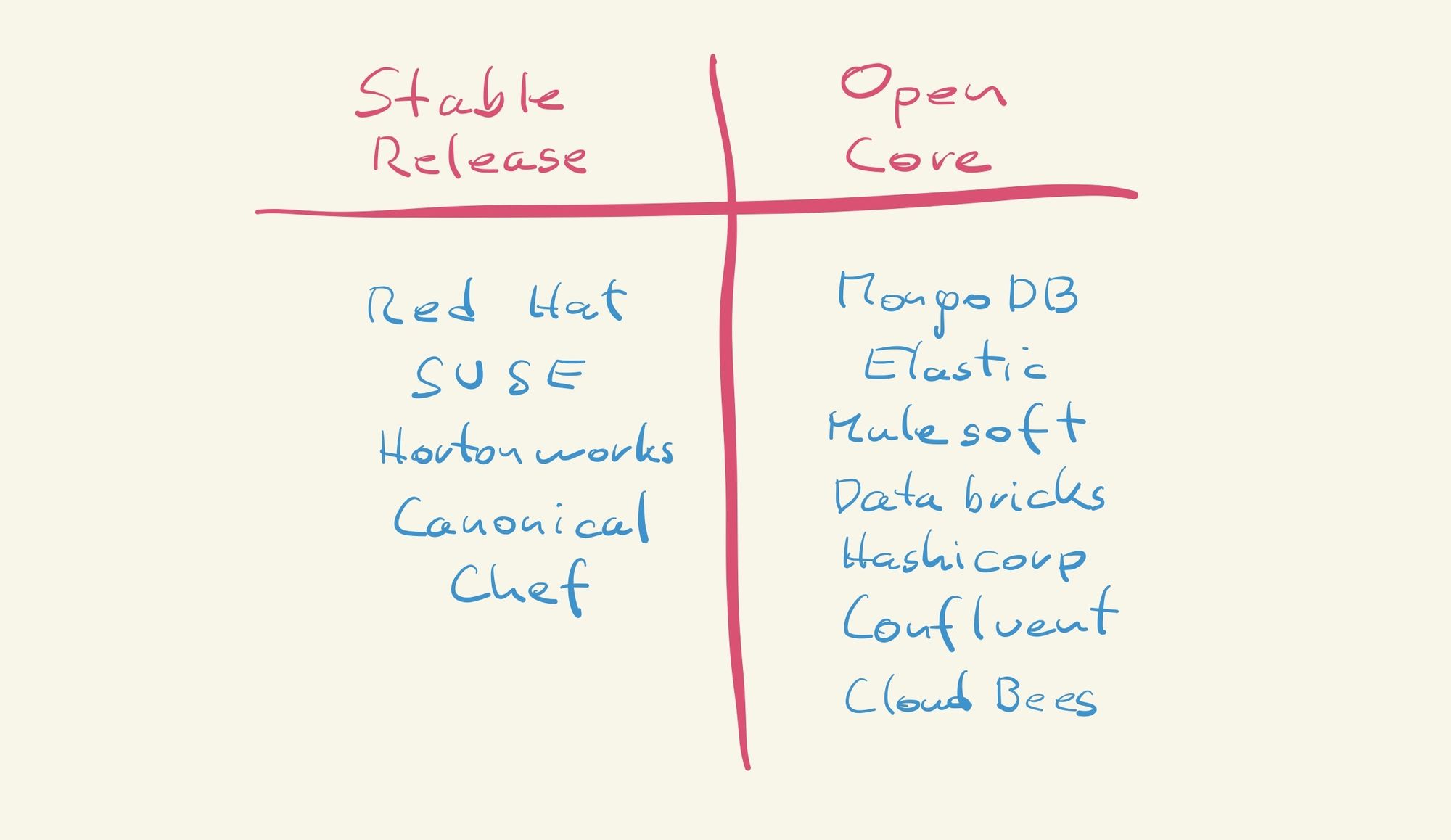

There are many other commercially successful open source vendors (e.g., Confluent or Hashicorp are still private companies). Over the next year, we will see many of them go public. What they all have in common is that they are monetizing open source software. But that’s where the similarities end. Red Hat’s business model is distinctively different from those of the newer vendors (MongoDB, Elastic, Confluence, Hashicorp, etc.). You can categorize all open source companies into two groups based on their business model:

- Selling a stable and tested release of the open source project plus professional services, indemnifications, support, or training.

- Selling additional capabilities that are enhancing the open source project and aren’t open source.

Despite Red Hat’s success, its model is the exception nowadays. All high-growth open source vendors tend to have an open core model.

- Hortonworks went public, struggled, and eventually merged into its main competitor - Cloudera. It suffered from below-average gross margins and low revenue growth[2].

- Chef switched to the Red Hat model in 2019, but it seems like that they aren’t on the high-growth/IPO track anymore due to the configuration management market's structural issues[3].

- SUSE was acquired several times and is currently owned by a PE firm. It’s likely never becoming a high-growth company again. Canonical is similar[4].

Why Open Core is the better model for monetizing open source projects is worth another blog post. What’s clear is this. Nobody who applied the Red Hat model became a runaway success.

Red Hat’s Business Model was an Outlierhttps://t.co/cE7FyzTeBq

— Moritz Plassnig (@moritzplassnig) September 1, 2020

[1] Shomik Ghosh from Boldstart Ventures raised a good point about giving developers capabilities (through open-sourcing them or a free tier) which makes them “look like heroes” in front of their managers/execs (which in turn helps with bottom-up adoption).

[2] Hortonworks eventually reached 75% subscription revenue and an overall gross margin of 73% but paired with heavy losses. Merging with Cloudera was the only way to stop the race to the bottom.

[3] Containers + Kubernetes changed the deployment model drastically to the disadvantage of Chef. The most likely outcome in the absence of having the profile of a high growth company is a PE acquisition.

[4] SUSE/Canonical are the most similar to Red Hat which might mean that they are also the only other vendors that could successfully apply the Red Hat model. But, Red Hat sold at their peak because its core business in the cloud world was increasingly at risk.