Many people think of MongoDB as the prime example of how to transform from a legacy software vendor to a modern cloud or SaaS vendor. That’s for a good reason. MongoDB grew Atlas, their SaaS offering, from less than $1M in revenue to more than $270M in four years. They are the most valuable public open-source company right now.

There are other companies (Elastic, JFrog, Splunk - to name a few) that are transforming along the same lines:

- The majority of revenue is legacy/software

- They have a forward-looking strategy that’s cloud/SaaS-first

- A bumpy ride along the way

Most people overlook one name - Talend (no, that’s not a typo). How come that nobody is paying attention to this little French company in the data warehouse space with nearly $300M in ARR? In a time when any company that uses the words “data” and “dev” in the same sentence can raise millions, this is odd.

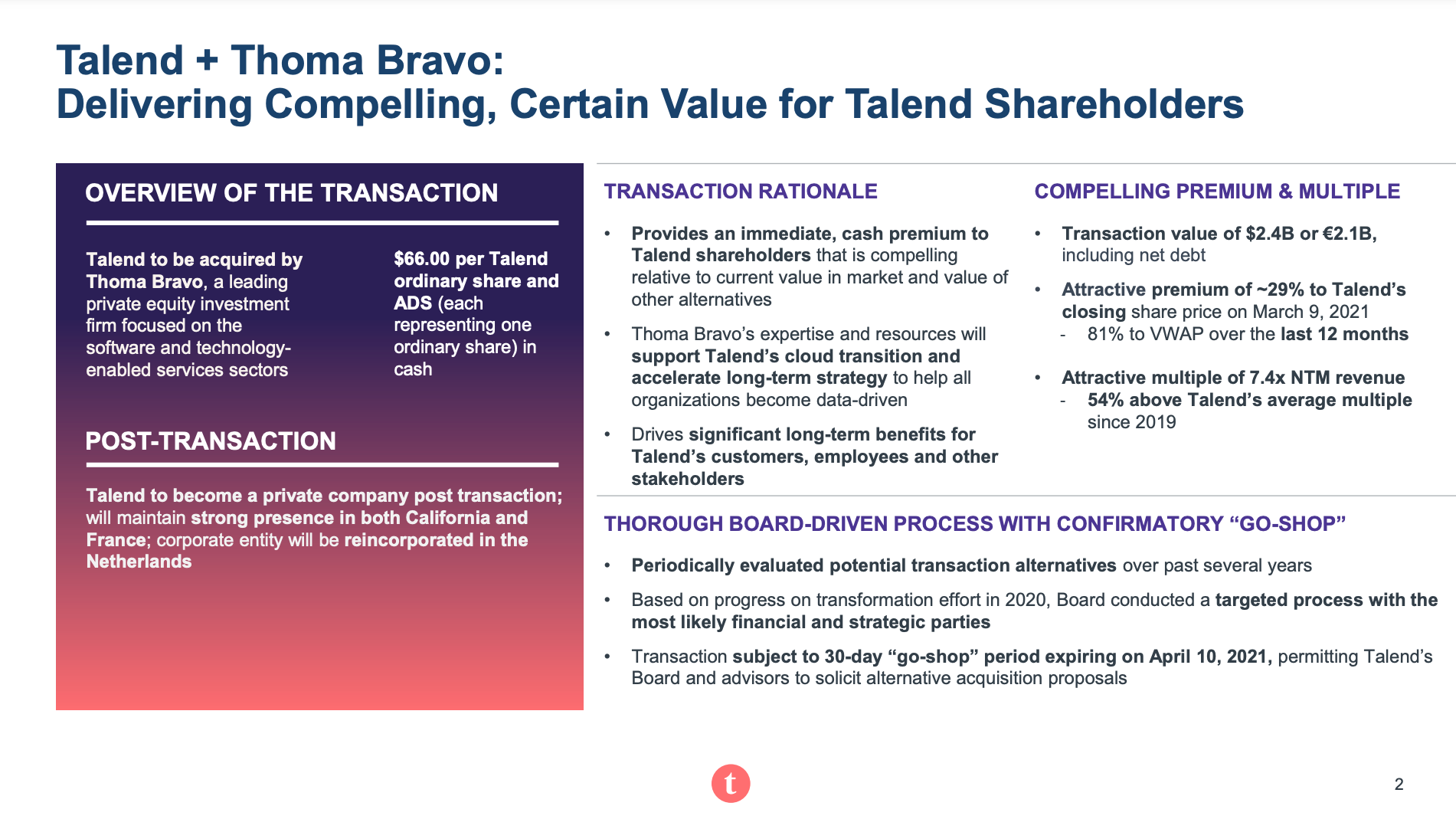

To be fair, Thoma Bravo thinks Talend is undervalued as well and announced their intent to acquire them for $2.4B this week. That’s a 29% premium on the closing share price of March 9, a 7.4x NTM revenue multiple.

It looks like a healthy exit, but nothing compared to Snowflake’s 60x+ NTM multiple. So what’s the backstory?

What or Who Is Talend?

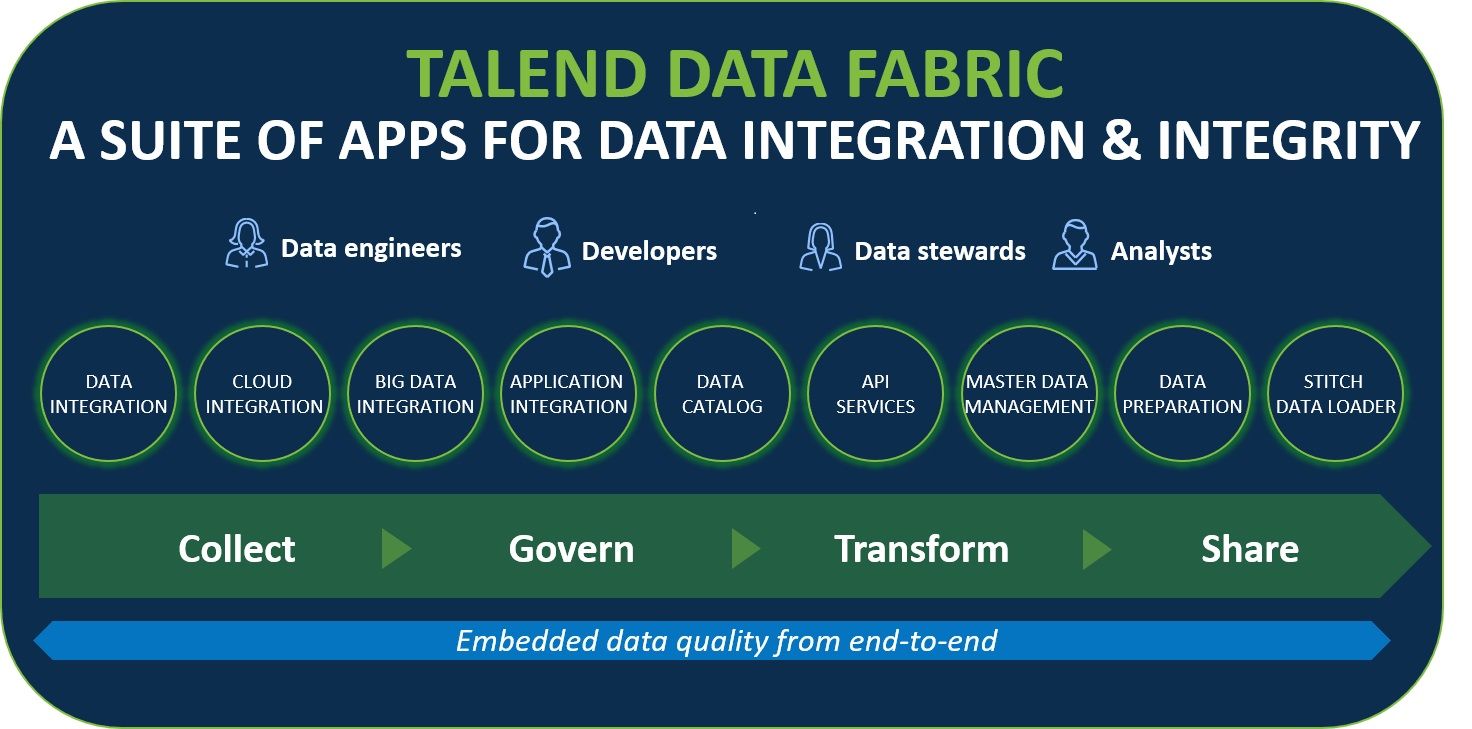

Talend was founded in 2006. It’s an open core vendor focusing on data integration, transformation, and data quality. In a nutshell, Talend helps you pipe data from A to B and manipulate it according to your use case. Back then, Talend’s products integrated with all the relevant products and open-source projects of that time, like Hadoop.

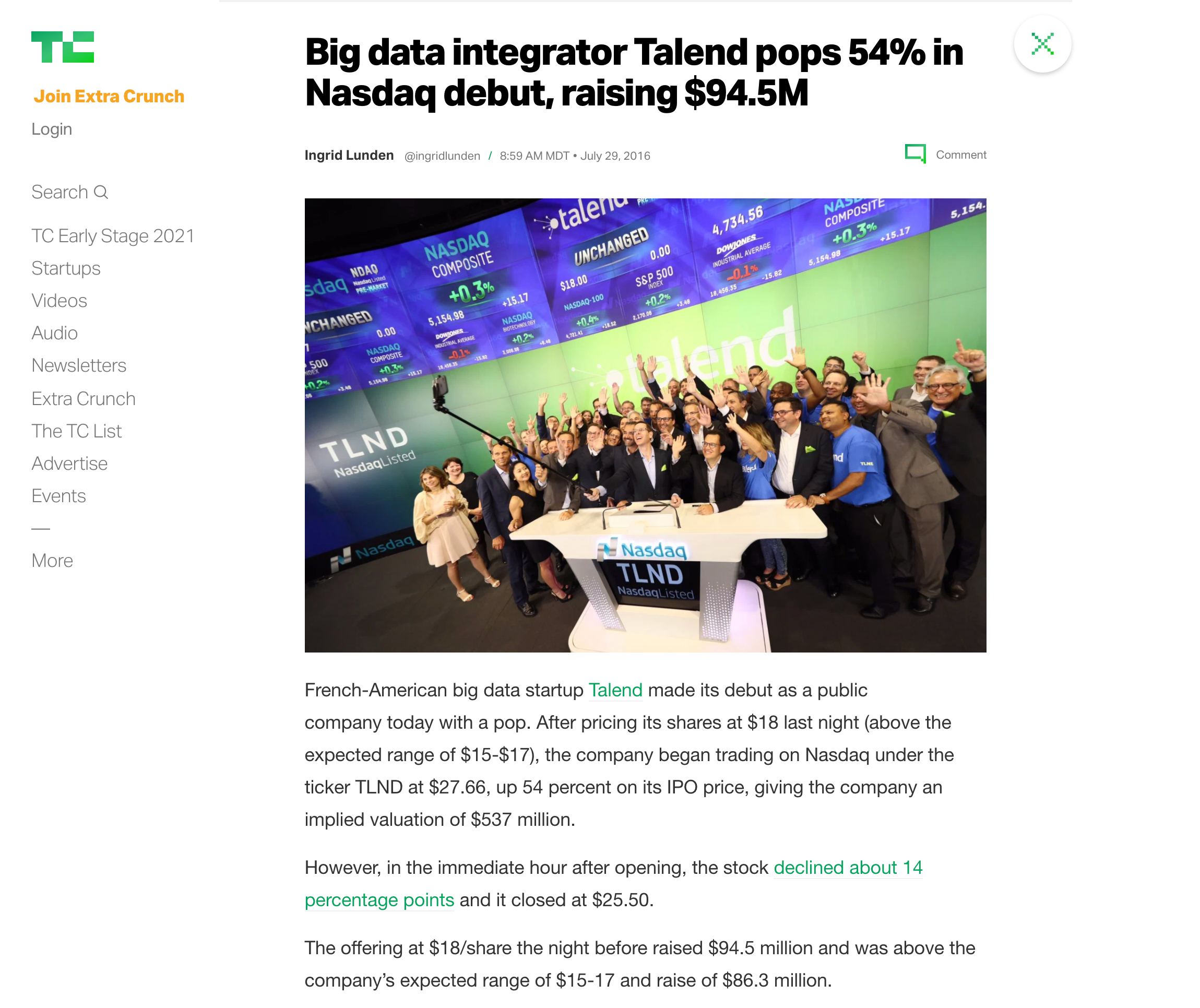

Talend is one of the “OGs” of the data integration space. They went public in 2016. Back then, we still said “big data,” and investors valued companies in “Millions” ($537M to be precise in Talend’s case). What a weird world. Talend’s IPO popped and jumped by 54% on their first day as a public company. At least that sounds familiar.

In 2016, the world looked very different, and Snowflake was still a tiny unknown startup. 2016 was also the year when AWS crossed $10B in revenue. If you look at the most recent AWS numbers, that might not sound like a lot. AWS did more than $10B in revenue in just the last quarter of 2020. The rise of cloud computing changed everything, and it also changed how we store, integrate, or progress data. Within a few years, the state-of-the-art “big data” tooling became legacy technology, and the world moved on to modern, cloud-based data warehouses.

The shift to cloud computing resulted in a magnitude of problems for every pre-cloud data vendor:

- Data is stored/processed differently (ELT vs. ETL)

- Products are consumed differently (Cloud/SaaS vs. on-premise)

- Lots of additional data sources that are integrated differently (APIs vs. scripts)

- Shift from backward-looking analytics to real-time operational analytics (tools like Hightouch pushing data into end-user systems)

Talend’s first arc was riding the momentum around big data tools like Hadoop. By the time they went public, the basis of their success was already becoming irrelevant. Cloud computing and modern data warehouses like BigQuery changed everything, created a new ecosystem, and changed how customers preferred to run and integrate data.

Talend Goes Cloud

Talend saw the writing on the wall and transformed their business to become a cloud vendor. That’s much easier said than done. You need to rewire the whole company, change the DNA, develop new products, hire great but different talent and do all of that while your “immune system” rejects these new efforts. It’s hard.

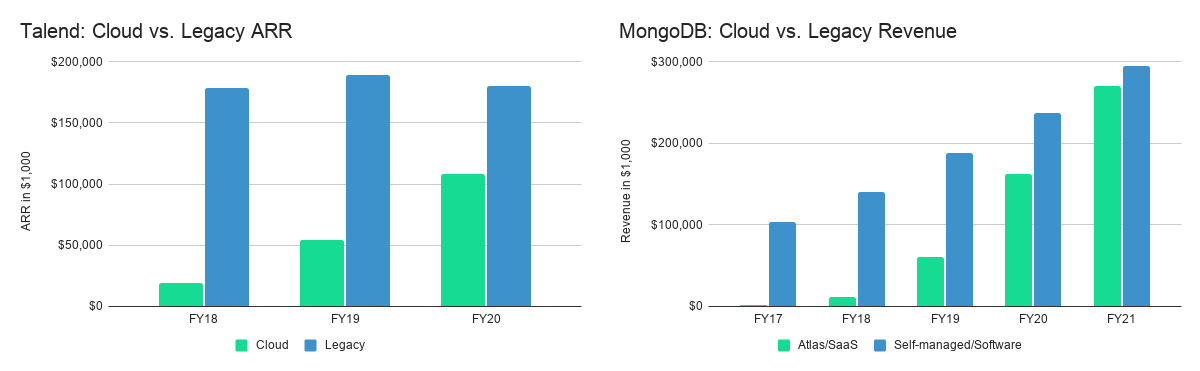

On the surface, Talend did well. They needed seven years to get to $100M+ in revenue, and they grew their cloud ARR from $19M to $108M in two years. This is not an apple-to-apple comparison, but Talend doesn’t disclose better data. Revenue lags ARR, although in most growing companies, not longer than a quarter usually. The trends on the chart below won’t materially change with better data.

Some of that growth was aided by acquiring Stitch, a cloud/SaaS data integration company. The acquisition added only ~$3-4M in ARR directly but gave the Talend sales team a complementary SaaS product to sell into the existing customer base. One of the advantages of selling SaaS is that it simplifies a corporate/inside sales/midmarket GTM motion. Serving customers with a lower ACV is challenging in an on-premise environment which often requires hands-on support and professional services. Talend had around 1,300 customers when they went public in 2016. By the end of 2018, it was 3,000, and at the end of 2020, Talend crossed 6,000 customers. They never became a “true” PLG company. For example, if you want to try Stitch today, you would need to request a trial. That’s good and bad. It opens them up for bottom-up disruption by companies like Fivetran. But it also is an opportunity if Talend keeps reinventing themselves and improves their product experience.

Talend’s customer growth in recent years was impressive. What stands out on the above chart is their stagnation in 2017. Drilling into it, you can see how Talend’s average revenue per customer first spiked and then decreased rapidly. This looks scary at first, but if overall revenue and customer growth are accelerating, this is a good sign. MongoDB’s business had the same characteristics. It shows that you can move downmarket and attract many more new customers, even though the initial ASP is lower. Eventually, that new customer base results in lots of expansion revenue and a high Net Dollar Retention Rate down the road if you retain the customers and grow them well.

Transformation Is Hard

Talend’s reinvention as a cloud/SaaS vendor is remarkable. Adding nearly $100M in cloud/SaaS ARR is a tremendous achievement. Compared to other vendors like Elastic or JFrog, Talend did well.

But, generating cloud/SaaS revenue is not all that matters. What’s equally important is if you will bring your existing customer base along. Are you adding net new customers and retaining existing ones? Are your current customers expanding their overall subscription because they keep some legacy/software workloads on-premise, migrate some to the cloud, and add new ones directly in the cloud? Or are you losing some of that historical customer base?

In Talend’s case, the traditional business stagnated and started shrinking. Which makes it even more astounding that they kept growing overall, and it shows the strength of their cloud/SaaS growth. Nonetheless, it’s not positive news. In 2018, Talend had $179M in legacy/software revenue. In 2019, it was $180M. Based on the recent trend, this number will likely decrease further in the future. To show what excellent means, it’s helpful to compare the numbers from above with MongoDB.

MongoDB consistently grows its Cloud/SaaS and Self-managed/Software business. Atlas, their SaaS product, is accelerating and growing faster but not at the expense of their legacy business. This dynamic resulted in an ever-decreasing NDR. Talend’s 107% is disappointing (an NDR of 130%+ is considered best-in-class).

Talend Is Undervalued in the Short Term

While Talend’s cloud business started to take off, its legacy/software business was suffering. Towards the end of 2020, the NDR began to stabilize at 107%. Q4 was Talend’s best quarter in delta ARR with ~$20M added. For 2021, Talend expected to add another $52M in ARR, with only 10-20% of that coming from migrating existing customers. It seems like their cloud business is mainly attracting a new customer base. The big question is whether all of this is good or bad.

I believe there’s a bullish case, at least for the next 2-3 years. If you ignore Talend’s legacy/software business, you end up with a cloud/SaaS startup that has the following characteristics:

- ARR: $108M

- % YoY Growth for 2021: 47%

- Accelerating quarterly delta ARR growth ($7M => $14M => $13M => $21M)

- A growing customer base that most likely grew more than twice in size in the last two years (3,000 => 6,000 overall, and most likely, the legacy/software segment in that number is ~1,000 max and shrinking)

- A much better NDR than 107% because cloud/SaaS is growing while legacy/software is shrinking (hence depressing the overall NDR)

- A healthy number of $100K+ ARR customers (~700 total, likely 50%+ legacy/software but similar to the total number of customers, the legacy/software segment is shrinking while the cloud/SaaS segment is growing)

This isn’t Snowflake, but still decent. For example, compared with JFrog, another tech company that went public in 2020:

| Metric | JFrog | Talend |

|---|---|---|

| Revenue (JFrog), ARR (Talend) | $151M | $108M |

| % YoY Growth | 44% | 50% |

| NDR | 133% | ~120-130% est. for Cloud/SaaS |

| $100K+ ARR Customers | 352 | ~300 est. for Cloud/SaaS |

It’s obviously not apples-to-apples. But, JFrog is trading at a 23x NTM revenue multiple, even after last week’s multiple compression. Talend sold at a 10x NTM cloud ARR, so probably 8x NTM revenue (which ignores the legacy/software revenue, which won’t disappear overnight). This is by no means a serious comparison or valuation evaluation. I actually believe JFrog is over-valued, and at the same time, Talend is undervalued.

My point is that Talend should receive more credit for their accelerating cloud business than they are getting.

Long story short, Thoma Bravo acquiring them right now seems to be a smart move. They can focus on accelerating the cloud/SaaS business, reduce the % of revenue on legacy/software, and bring Talend public again as a $200-300M cloud/SaaS company. The chances are high that this will result in a much bigger multiple and significant return for them.

If Talend's legacy business would disappear tomorrow, they would be a:

— Moritz Plassnig (@moritzplassnig) March 19, 2021

• $100M+ ARR company

• Growing 50%

• With an NDR of 120%+

• 300+ $100K+ customers - so some enterprise scale

Any data startup with those numbers would get drowned in term sheets and worth 💰💰💰 /11 pic.twitter.com/Xl5pa04pNu

The Iceberg Ahead

Long-term, the story looks very different. There are significant tailwinds in the data space, and modern data tools are growing incredibly quickly. At the same time, there are also massive headwinds for legacy vendors. Every fundamental shift in a market results in a whole new set of companies. If you think of modern data vendors, you think dbt, Fivetran, and Hightouch - not Talend Data Studio or Stitch. This shift is still a tiny wave and not a tsunami (yet). It’s clearly visible for early-adopters, but it’s not (yet) showing in terms of numbers.

The big unknowns are:

- When does it visibly start to hurt Talend?

- Is there a chance that Talend can truly become a part of the new ecosystem?

My bet on the first question is that it will take two to three years. Today, all these other vendors combined have less revenue than Talend’s cloud business. One of my favorite quotes is:

“The battle between every startup and incumbent comes down to whether the startup gets distribution before the incumbent gets innovation.”

Right now, Talend has the bigger GTM muscles and good momentum. Its shared customer base with Snowflake is >1,000, and the two companies are doubling down on their partnership. Talend is already part of the “new” ecosystem, but their brand and product aren’t entirely yet. Being a private company might help them double-down on cloud/SaaS with more freedom. But it’s hard to imagine that a PE-backed company ever out-innovates an up-and-coming startup, like Fivetran. It also takes time to build a well-working PLG motion. Once it starts working, it’s magic and hard to stop. If I had to place a bet, I would put my money on Fivetran, and that five years from now, Fivetran will be more successful than Talend.

Building an enduring and thriving company is hard. At the same time, it's a lot of fun, requires hard work, and is amazing to watch. From my outside perspective, Talend did a fantastic job in their first arc - building an open-source community, monetizing its proprietary product, and going public. Their second arc is all about reinventing themselves as a cloud/SaaS vendor, and so far, it’s going much better than their stock would indicate.

I’m excited for what’s ahead of them, and at the same time, skeptical about their long-term prospects. Only time will tell.

Talend - the Next Cloud Success Story?https://t.co/8n2nVoOYiW

— Moritz Plassnig (@moritzplassnig) March 14, 2021

[1] Source: https://www.sec.gov/Archives/edgar/data/1018724/000101872417000011/amzn-20161231x10k.htm

[2] Source: https://www.sec.gov/Archives/edgar/data/1018724/000101872421000004/amzn-20201231.htm

[3] Source: https://www.sec.gov/Archives/edgar/data/1668105/000166810519000005/tlnd-20181231x10k.htm

[4] Source: https://www.fool.com/earnings/call-transcripts/2021/02/11/talend-sa-tlnd-q4-2020-earnings-call-transcript/

[5] I don't know who to attribute it to but I read it here first: https://a16z.com/2015/11/05/distribution-v-innovation/